Restauration : calcul de la marge et des ratios

Quels sont les indicateurs de performance en restauration, quel est le calcul marge restaurant, comment définir le prix de ventes d’un plat, comment utiliser le coefficient multiplicateur en restauration ? Voici quelques une des questions qui nous sont régulièrement posées. Nous allons donc dans cet article distinguer les différents indicateurs utilisés en restauration. Ces indicateurs de performances permettent au gérant de contrôler la gestion globale de son restaurant, de maintenir l’équilibre et de s’assurer de la santé financière de son établissement.

Le taux de marge brute est un indicateur clé. En effet, il permet de fixer le prix de vente des produits de votre entreprise commerciale. Il est donc primordial d’optimiser au mieux ce taux. Cela passe en particulier par le prix des achats de matière première et des marchandises qui servent à votre production.

Essai gratuit | Application Koust

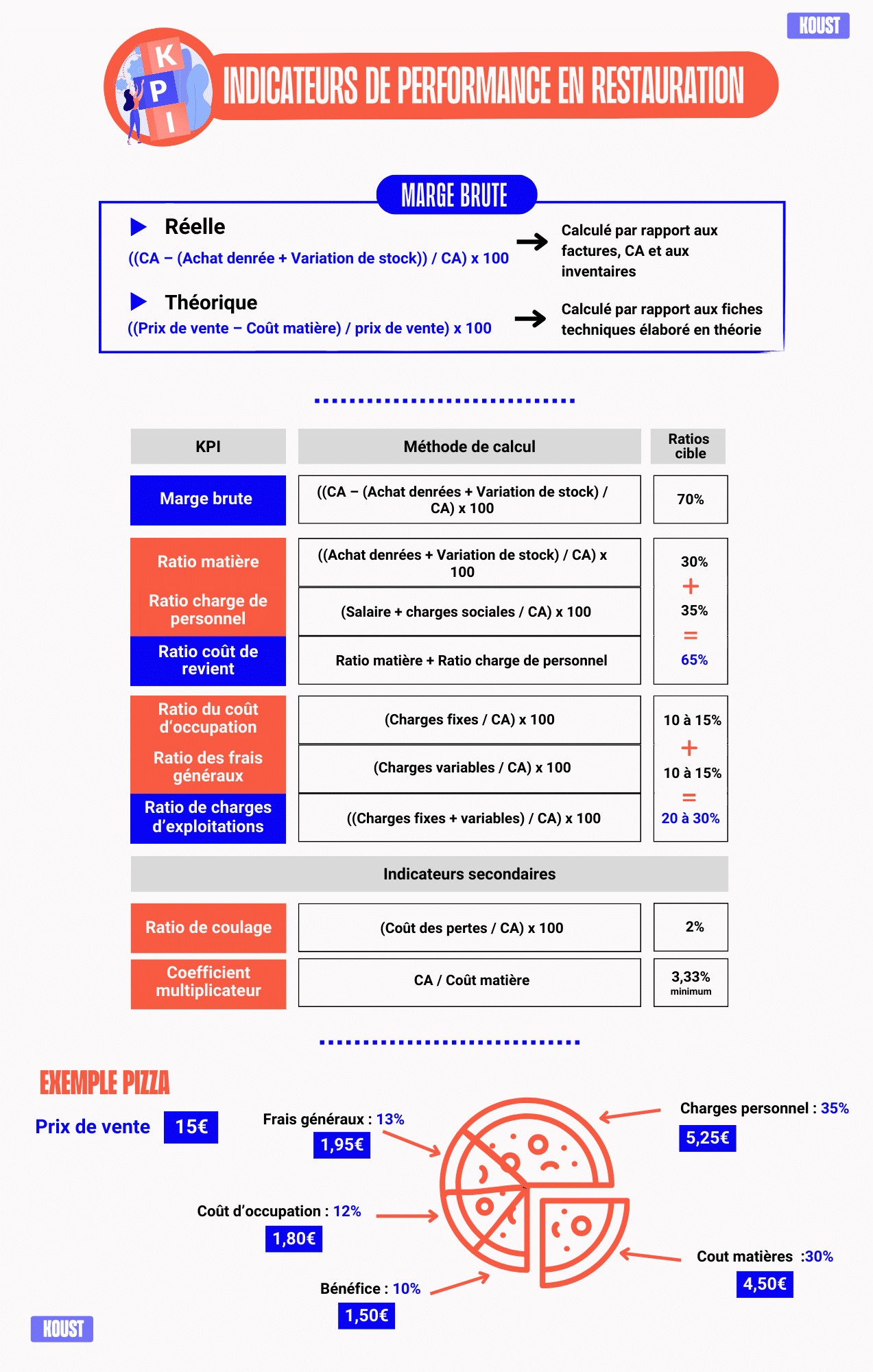

Indicateur principal de Calcul marge restaurant

La marge brute

Pour une activité comme la restauration, le premier indicateur de performance analysé est la marge brute.

Elles n’est autre que le chiffre d’affaires réalisé auquel l’on a soustrait le coût des matières premières. Le calcul de la marge brute se fait de façon théorique, lors de la création d’un plat ou de façon réel sur une période définie.

Dans ce deuxième cas, le calcul marge brute ce fait au niveau global du restaurant ou sur l’un des pôles d’activités (bar, cuisine, snack…) à condition d’avoir isolé les ventes ainsi que les achats de matières premières.

La marge brute générée doit permettre de couvrir l’ensemble des frais (hors coût matière) tout en générant un bénéfice.

Il faut bien différencier la marge brute théorique de la marge brute réelle.

Calcul marge brute théorique

Il s’effectue sur les fiches techniques, généralement pour une portion.

Lors de la création d’un restaurant ou d’une nouvelle carte, on anticipe le coût des matières premières via les fiches techniques (théorie). Ce sont des prévisions qui ne tiennent pas compte de la qualité de la gestion de stock. Les ingrédients sensibles (fragile et/ou chère) sont sujets à la perte (DLC dépassé, proportions mal respectées, vol, casse, etc.). Autant de facteurs qui altèrent la performance de la marge brute réelle.

Calcul de marge brute théorique = ((Prix de vente – Coût matière) / prix de vente) x 100

Calcul marge brute réel

Il s’effectue sur une période définie (jours, mois, année…). Elle prend en compte les achats, la variation de stock, les ventes réelles, ainsi que les pertes, casses et offerts altérant vos prévisions théoriques.

Calcul de marge brute réel = ((CA – (Achat denrée + Variation de stock)) / CA) x 100

Analyse des résultats

La marge brute doit être régulièrement analysée (par jour, mois, trimestre, année, etc.) ainsi que par secteur (bar, cuisine, snack, etc.).

Quelle est son évolution ? Est-elle en baisse ? Des réflexions que mène cette analyse, découle votre stratégie à court et moyen termes. Identifier les mauvaises performances et leurs origines permet de mettre en place des actions correctives pertinentes.

Renégocier vos prix d’achats avec vos fournisseurs, revoir la composition de vos recettes, améliorer votre gestion de stocks ou encore renforcer vos produits leaders sont autant d’actions correctives qui mise ensemble permettent d’améliorer votre marge brute.

Les ratios utilisés

Ratio matière (Food cost)

Le ratio matière (Food Cost en anglais) est tout simplement le coût des matières premières utilisées, exprimé en % du CA.

Il permet de vérifier l’importance du coût matière par rapport au CA réalisé.

Tout comme la marge brute, il se calcule en théorie sur la fiche technique, et en réel sur une période définie.

Généralement, un ratio matière cible est fixé par la direction. Le chef de cuisine a pour objectif de le respecter. Un ratio matière trop élevé va forcément diminuer la marge brute au risque de voir l’équilibre financier du restaurant altéré.

Ratio matière = ((Coût matière + Variation de stock) / CA) x 100

* Variation de stock = Stock début de période – Stock fin de période

Calcul marge : Ratio de charge de personnel (Labor cost)

Le ratio de charge de personnel représente le % du CA alloué aux salaires et charges sociales.

Le coût de la main d’œuvre est élevé en restauration, il représente en moyenne entre 35 % et 40 % du CA.

Ratio de charge de personnel = (Coût main d’œuvre / CA) x 100

Ratio du coût de revient (Prime cost)

Le ratio de coût de revient est un ratio spécifique à la restauration. Il est égal à la somme du ratio matière et du ratio de charge de personnel.

Ce ratio représente donc le % du CA alloué à la réalisation des plats (coût matière + personnel). Il doit ce situé au alentour des 65 % du CA.

Ratio du coût de revient = Ratio matière + Ratio de charge de personnel

Plus d’information concernant le cout de revient ici : https://koust.net/calcul-cout-revient-restauration/

Calcul marge : Ratio du coût d’occupation

Le coût d’occupation est composé uniquement des charges fixes (loyers et charges locatives, emprunts…). Il constitue à peu près 10 % à 15 % du CA.

Ratio du coût d’occupation = (Charge Fixe / CA) x 100

Ratio des frais généraux

Vos frais généraux sont composés de vos charges variables (gaz, électricité, impôts et taxes, commission sur les moyens les paiement, personnel extérieur, publicité…). Il avoisine les 10 % à 15 % du CA.

Ratio des frais généraux = (Frais généraux / CA) x 100

Ratio de charges d’exploitation

Le Ratio de charges d’exploitation représente le % du CA alloué aux charges fixes et variables du restaurant. Il est le cumule du coût d’occupation et des frais généraux. Il se situe autour de 25 % à 30 % du CA.

Ratio de charge d’exploitation = ((Charges fixe + Charges variable) / CA) x 100

Ratio de coulage

Le ratio de coulage correspond à l’impact des pertes (casse, produit périmé, vol…) sur votre CA.

Pour pouvoir le calculer, il faut peser les pertes et les renseigner (logiciel de gestion, Excel…) afin d’en calculer le coût. Attention, ce ratio est très important et parfois difficile à quantifier. Il ne doit pas dépasser les 2 % du CA

Ratio de coulage = (Cout des pertes / CA) x 100

Récapitulatif des ratios utilisés en restauration

Un suivi mensuel des ratios et essentiel afin de vérifier la bonne maitrise des coûts. Cela permet d’identifier rapidement les axes d’améliorations ainsi que les actions correctives à entreprendre.

| Indicateur de performance | Méthode de calcul | Ratio cible |

| Marge Brute | ((CA – (Achat denrées + Variation de stock) / CA) x 100 | 70% |

| Ratio matière (Food Cost) | ((Achat denrées + Variation de stock) / CA) x 100 | 30% |

| Ratio charge de personnel (Labor Cost) | (Salaire + charges sociales / CA) x 100 | 35% |

| Ratio coût de revient (Prime Cost) | Ratio matière + Ratio charge de personnel | 65% |

| Ratio du coût d‘occupation | (Charges fixes / CA) x 100 | 10 à 15% |

| Ratio des frais généraux | (Charges variables / CA) x 100 | 10 à 15% |

| Ratio de charges d’exploitations | ((Charges fixes + variables) / CA) x 100 | 25 à 30% |

| Ratio de coulage | (Coût des pertes / CA) x 100 | 2% |

| Coefficient multiplicateur (solide) | CA / Coût matière | 3,33 min |

Autres indicateurs Calcul marge : Le coefficient multiplicateur

Le coefficient multiplicateur est un outil qui permet de définir le prix de vente d’un plat en fonction du coût matières de celui-ci (exemple 1). Il est parfois utilisé comme indicateur de performance en le calculant pour l’ensemble des prestations du restaurant (exemple 2).

Le coefficient multiplicateur est égal au rapport entre votre « Prix de vente HT » et votre « Cout matière ».

Pour un ratio matière de 30 % sur les solides, le coefficient multiplicateur est de 3,33. Pour les liquides, il peut être très variable, en moyenne, il se situe au alentour de 4 à 6.

Exemple 1 :

Vous souhaitez proposer un plat d’Osso Bucco à votre clientèle, vous connaissez votre coût matière et cherchez à définir votre prix de vente TTC.

Votre plat vous coute 3 € HT en matière première par portion.

La TVA de vente est de 10 %.

Le coefficient multiplicateur moyen en restauration est de : 3,33.

Donc : (Coût matière x coef multiplicateur) x TVA = Prix de vente TTC

Donc : (3 € x 3,33) x 1,10 = 11 € TTC

Vous pouvez proposer votre plat au prix de 11 € TTC afin de pouvoir couvrir l’ensemble de vos frais avec la marge brute généré.

Exemple 2 :

Vous souhaitez analyser votre coefficient multiplicateur moyen réalisé sur l’année n-1

Le calcul est le suivant : CA / Cout matière = Coefficient multiplicateur moyen de l’année n-1.

Tout comme la marge brute, il est idéal de contrôler le coefficient multiplicateur moyen réalisé par période et, si possible, par pôle d’activité.

Le ticket moyen

Le ticket moyen est l’addition moyenne de votre clientèle. Il se calcule par jour, semaine, mois, année… Il est le rapport entre votre CA et votre nombre de clients. Un ticket moyen en hausse signifie que votre clientèle ne consomme plus ou des produits chers. Il est un bon indicateur du budget moyen de votre clientèle ou encore, de la performance de vente de votre équipe.

Ticket moyen = CA TTC / Nombre client

Conclusion calcul marge

Nombre d’indicateurs de performances sont utilisés en restauration. Leur but est de vérifier le bon équilibre financier du restaurant. Ils permettent d’identifier la source de dépense trop lourde afin d’en déterminer l’origine et de mener à bien des actions correctives ciblées. Un contrôle mensuel des ratios est donc essentiel.

Essai gratuit | Application Koust

Pour plus d’informations contactez-nous.